unlevered free cash flow vs levered

It compares the volatility associated with the change in prices of a security. Before discussing the differences between levered vs unlevered beta itd be best to take a step back by defining the two types of risks.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Terminal value is the value of a companys expected future Cash Flow to Firm beyond the.

. A higher LCF makes the business attractive to. To illustrate the computation of levered beta. Most DCF valuations use the unlevered cash flow available to the company the Free Cash Flow to Firm.

The Most Useless Concepts in Valuation. FNRP is a private equity commercial real estate firm that creates risk-adjusted returns for our investors. Levered Free Cash Flow and the Levered DCF.

This Investment Banking course will focus on understanding what Free Cash Flows are in general and why FCFF and FCFE should be used to measure companys operating performance. Why use Unlevered Free Cash Flow UFCF vs. Lets say that you use Levered Free Cash Flow rather than Unlevered Free Cash Flow in your DCF - what is the effect.

When evaluating potential returns for a real estate investment investors may often have to consider levered vs. Fundamentally the value of a commercial real estate asset is derived from the amount of cash flow that the property produces. Definition Types and Examples Save Time Billing and Get Paid 2x Faster With FreshBooks.

Also referred to as levered free cash flow The primary difference between FCFF and FCFE is interest payments and taxes as FCFE includes interest expense paid on debt and net debt issued or repaid. Levered Free Cash Flow gives you Equity Value rather than Enterprise Value since the cash flow is only available to equity investors debt investors have already been paid with the interest payments. Free Cash Flow Margin.

Free Cash Flow vs. The margin will be higher for unlevered FCF than for levered if the company has any debt. One is the Free Cash Flow to the Firm and the other is Free Cash Flow to the Equity.

In others this isnt the reality. Video Tutorial With Excel Examples. Equity Beta is commonly referred to as levered beta ie a.

You can find out more information by visiting our revision policy and money-back guarantee pages or by contacting our support team via online chat or phone. In our previous post we discussed the meaning and calculation of free cash flow to firm FCFF which is often referred to as unlevered free cash flow. The amount of cash generated by a company that is available to stock investors.

A complex provision defined in section 954c6 of the US. Levered Beta or Equity Beta Equity Beta Equity Beta measures the volatility of the stock to the market ie how sensitive is the stock price to a change in the overall market. Levered Beta Formula Example 1.

The reason for this is that the effects of debt financing have been removed namely interest expense the tax shield ie savings from interest being tax-deductible and principal. Let us take the example of a company named JKL Inc. Internal Revenue Code that lowered taxes for many US.

FCFE Guide 4 Terminal Value. As an example let Company A have 22 million dollars of cash from its business operations Cash Flow Cash Flow CF is the increase. However the main challenge with the DCF valuation is that it requires a set of forward-looking assumptions which normally are quite subjective and more often are subject to.

How to Calculate EBITDA 1411 Created with Sketch. SMBs can and do start up on their own financial accord. As the name indicates the Free.

Margin tells us what portion of sales ends up as FCF. We know how important any deadline is to you. Unlevered Free Cash Flow vs.

The Discounted Cash Flow method uses Free Cash Flow for a set number of years either 5 10 or so on and then discounts those cash flows using the Weighted Average Cost of Capital to reach a certain valuation for the company. Free cash flow Operating cash flow capital expenditures. Unlevered free cash flow.

A UFCF analysis also affords the analyst the ability to test out different capital structures to determine how they impact a companys value. Unlevered cash flow is before the company meets its obligations. EBIT Earnings before Interest.

Global pandemic recessions Often called market risk these risks cannot be mitigated through portfolio. Every sweet feature you might think of is already included in the price so there will be no unpleasant surprises at the checkout. The formula below is a simple and the most commonly used formula for levered free cash flow.

Most information needed to compute a companys FCF is on the cash flow statement. Unlevered free cash flows change in financial debt interest correction for effective taxes paid. Also referred to as unlevered free cash flow Free cash flow to equity FCFE.

Unlevered Free Cash Flow UFCF Levered free cash flow is the amount of cash a business has after paying debts and other obligations. Systematic risk is inherent to public equities rather than impacting just one specific company eg. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made.

The look thru rule gave qualifying US. Free Cash Flow Operating Cash Flow CFO Capital Expenditures. Free Cash Flow margin is a ratio in which FCF is the numerator and sales is the denominator.

UFCF is the industry norm because it allows for an apples-to-apples comparison of the Cash flows produced by different companies. Levered Free Cash Flow 2013 Created with Sketch. Thats why everyone in our company has their tasks and perform them promptly to provide you.

So why use both. Levered free cash flow vs. Levered Free Cash Flow LFCF.

It is a public listed company and as per available information its unlevered beta of 09 while its total debt and market capitalization stood at 120 million and 380 million respectively as on December 31 2018. A plagiarism report from Turnitin can be attached to your order to ensure your papers originality. In some contexts this is the reality.

Unlevered free cash flows free cash flows to firm. Chat with your writer and come to an agreement about the most suitable price for you. Levered Free Cash Flow LFCF vs.

Levered free cash flows free cash flows to equity shareholders. By contrast in an LFCF. Top 7 Differences Account Balance.

Please find the links to the guides on DCF here FCFF Formula. Your writer will make the necessary amendments free of charge. Unlevered Free Cash Flow.

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. There are two types of Free Cash Flows. Free Cash Flow to Equity FCFE Definition.

Levered cash flow EBITDA change in net working capital capital expenditures debt payments Levered cash flow is money a company can use to pay out dividends and invest in the business. Unlevered free cash flow provides a. Levered free cash flow is different from unlevered free cash flow because the latter assumes all capital is owned and none has been borrowed.

EBIT 1-tax rate CAPEX Addback Depreciation Change in Net Working Capital.

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Vs Levered Fcf Yield Formula Example Calculation

Understanding Unlevered Cash Flows In Real Estate Top Shelf Models

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

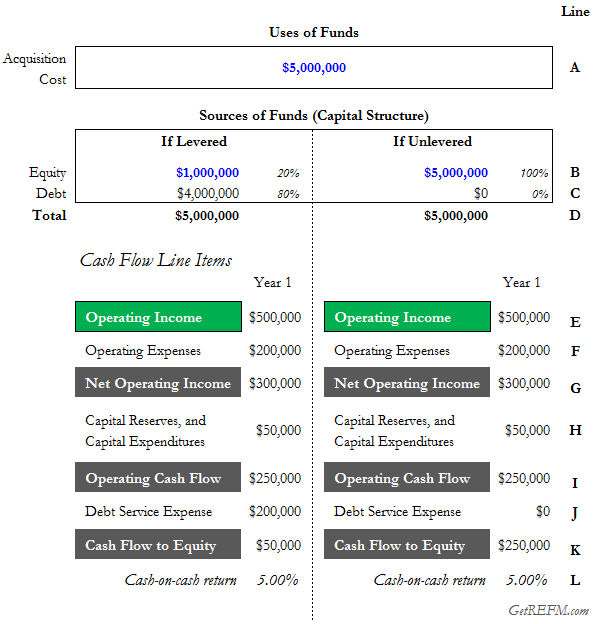

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis